Credit scores

(Last updated: September 2021)

In this article, we'll talk all about credit scores -- what they are, what their distributions look like, what to do if you have a low credit score, and other topics.

Here are some links that will jump you right to a particular section of this article:

- What is a credit score?

- What is a credit report?

- There are 3 main types of credit score: FICO, VantageScore, and others

- What's a good credit score?

- How are credit scores calculated?

- Frequently-asked questions about credit score components

- How to improve your credit score

What is a credit score?

A credit score is a number that corresponds to a person's "credit-worthiness", i.e., the likelihood that they'll be able and willing to pay back debts, based on their credit history.

What is a credit report?

A credit report is a historical summary of a person's debts and loan payments. Credit reports contain details about:

- Existing credit accounts

- Payment history

- Credit inquiries

- Amount of outstand debt

- Credit limit levels

- Prior bankruptcies & liens

Credit score vs. credit report

(You can think of the credit report as being the long document that describes your past loans and payments, and the credit score as being a value that attempts to categorize how good or how bad all of that history was, all things considered.)

There are 3 main types of credit score: FICO, VantageScore, and others

Those three types are:

- FICO: Uses a credit scoring model designed by the Fair Isaac Corporation.

- VantageScore: An alternative to FICO developed by Equifax, Experian, and TransUnion in 2006.

- Others: Some websites use their own proprietary algorithm to assign their own score. These scores often attempt to estimate the approximate FICO score or VantageScore of a person, but without needing to pay the extra fee associated with those scores.

What is the average FICO credit score?

In the US, the average FICO credit score is approximately 711. (Source: The Ascent report.)

More specifically, the distribution of credit scores in the US looks approximately like this:

|

Credit score range |

% of the US population |

|

800-850 |

20% |

|

740-799 |

20% |

|

670-739 |

20% |

|

580-669 |

20% |

|

Below 580 |

20% |

By age (as of 2020):

|

Age |

Average FICO |

|

18-24 year olds |

674 |

|

25-40 year olds |

679 |

|

41-56 year olds |

698 |

|

57-75 year olds |

736 |

|

76+ year olds |

758 |

What is the average VantageScore credit score?

In the US, the average VantageScore is 688. (Source: The Ascent report.)

By age (as of 2020):

|

Age |

Average FICO |

|

18-24 year olds |

654 |

|

25-40 year olds |

658 |

|

41-56 year olds |

676 |

|

57-75 year olds |

716 |

|

76+ year olds |

729 |

What's a good credit score?

Quick answer: 670+ for FICO, 661+ for VantageScore.

Longer answer: Although different adjectives are used for FICO ranges vs. VantageScore ranges (e.g., "Excellent" vs. "Exceptional"), the table below tries to approximately compare them side-by-side.

|

Rating |

FICO score range |

VantageScore range |

|

Excellent |

800-850 |

781-850 |

|

Good to Very Good |

670-799 |

661-780 |

|

Fair |

580-669 |

601-660 |

|

Very Poor to Poor |

Below 580 |

Below 600 |

How are credit scores calculated?

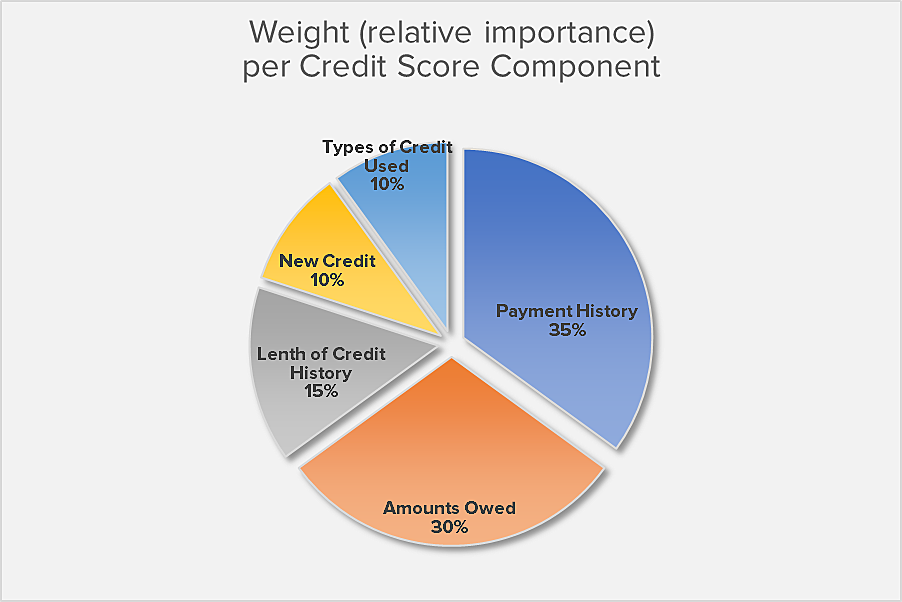

Although each credit bureau assigns slightly difference levels of importance to the different factors, here's an example breakdown of the approximate relative level of importance for each component:

|

Credit Score Component |

Key Questions |

Weight (relative % that it contributes to credit score) |

|

Payment history (e.g., your history of paying on time) |

|

35-40% |

|

Amounts owed (amount of outstanding debt) |

|

30-35% |

|

Length of credit history |

|

10-15% |

|

New credit accounts |

|

10% |

|

Types of credit used (revolving, mortgage, etc.) |

|

5-10% |

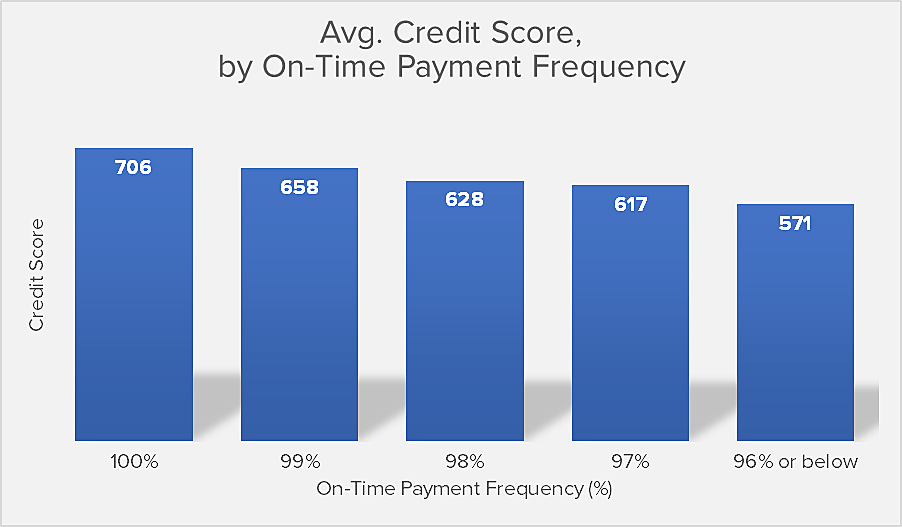

Payment history

This category ranks highest in impact, as 35-40% of your credit score is based on how well you handled credit in the past.

Creditors consider on-time payments to be a strong indicator of how well you will handle future credit. Factors that negatively affect this category are late/missed payments and derogatory marks such as bankruptcy, liens, foreclosures, or judgments.

A few late payments are not necessarily a deal-breaker when applying for credit, so long as you maintain high marks in other categories. In fact, there's even a scale for adjusting credit scores after a late/missed payment. For example, your reduced score will take into account how late the payment is, how much was owed, how recently the late payment occurred, and how many late payments you have in total.

Here's a look at the relationship between on-time payment frequency and credit score:

| Percentage of payments that are on-time | Avg. credit score |

| 100% of payments | 706 |

| 99% of payments | 658 |

| 98% of payments | 628 |

| 97% of payments | 617 |

| 96% or below | 571 |

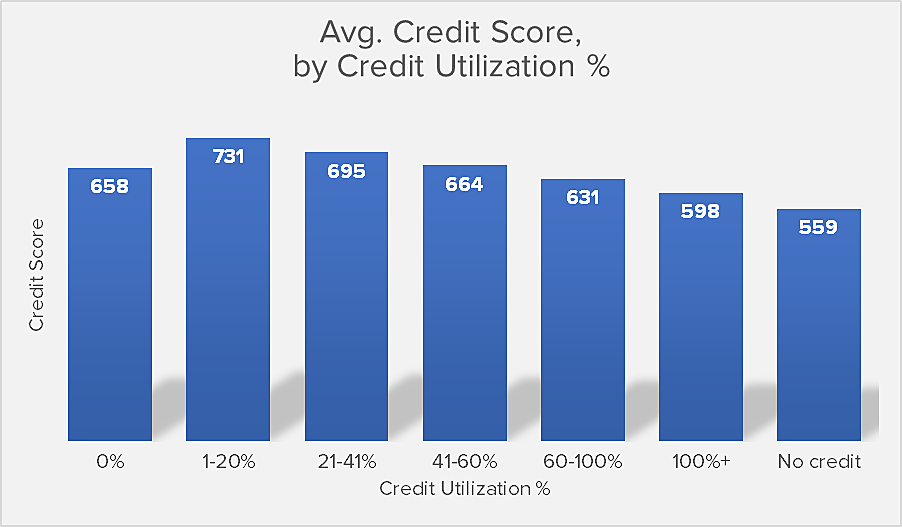

Amounts owed

The amount of debt owed comprises 30-35% of your credit score.

Many consumers are under the impression that carrying any debt negatively influences their credit score, when in fact, never having debt at all is actually more harmful. Making transactions using credit accounts and responsibly paying those accounts indicates to lenders that you can use credit wisely. It’s much harder to assess credit risk if a consumer never carries a balance. Thus, it’s smart to regularly keep a small debt on your credit accounts—groceries, a tank of gas, etc.—and pay it off.

What’s important is how heavily you're utilizing your open credit lines. For example, a consumer that has $50,000 in open credit but only has $10,000 in credit debt is utilizing 20% of available credit. However, someone with the same amount of open credit who has $25,000 in credit debt is utilizing 50%, which is much more risky to creditors. The lower your utilization rate, the better your score. Many lenders and experts feel that ideal credit utilization is below 30%.

Here's a look at the relationship between credit utilization % and credit score:

| Credit utilization percentage | Avg. credit score |

| 0% | 658 |

| 1-20% | 731 |

| 21-40% | 695 |

| 41-60% | 664 |

| 61-99% | 631 |

| 100% or more | 598 |

| No credit | 559 |

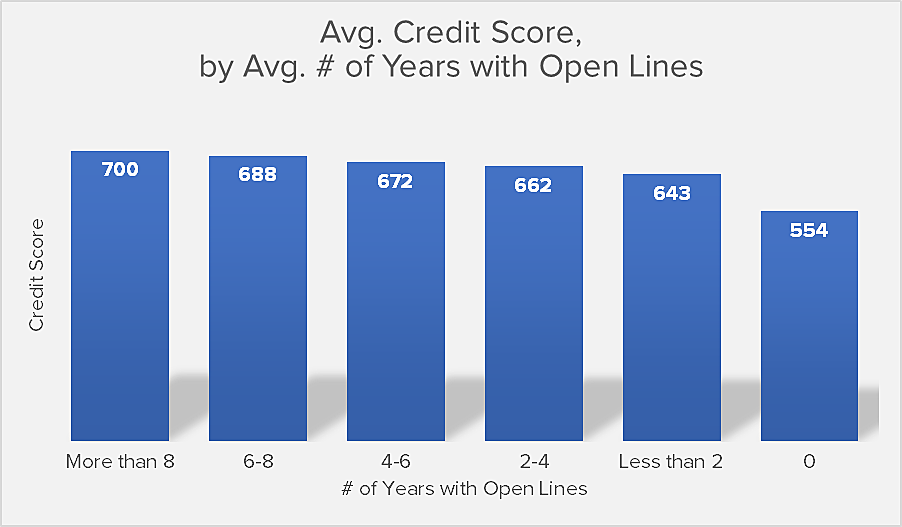

Length of credit history

Unfortunately, there’s not much consumers can do to quickly improve this component, but the good news is that length of credit history is only worth 10-15%.

Several factors are taken into consideration:

- The age of your oldest credit account, newest credit account, and average of all accounts

- How long specific types of accounts have been established

- How long it has been since you utilized certain types of accounts

One of the most common mistakes consumers make is paying down debt and then closing their old accounts. Sure, you may never need or want to use that credit card again once a debt has been paid, but this action will hurt your credit score. Instead, use the card occasionally, as carrying small balances will keep those accounts open and in good standing. There's no disadvantage to maintaining multiple accounts with small balances, since the biggest concern is a high credit utilization %.

Here's a look at the relationship between one's length of credit history and credit score:

| Avg. # of years with open lines | Avg. credit score |

| More than 8 years | 700 |

| 6-8 years | 688 |

| 4-6 years | 672 |

| 2-4 years | 662 |

| Less than 2 years | 643 |

| 0 years (no credit history) | 554 |

New credit

"New credit", or the amount of inquiries against your credit profile, accounts for about 10% of your credit score.

Many consumers don’t realize that every time they sign up for good deals (e.g., credit cards with 0% APR balance transfers, retail charge cards that offer 15% off of a purchase, etc.), "inquiries" are created. Creditors take a peek at your credit profile to judge credit worthiness and assess potential risk before extending credit or determining rates. There are even more complex factors at work, however.

First, consumers have to understand the difference between hard and soft inquires:

- A hard inquiry appears on a credit profile and can be seen by other creditors. Hard inquiries require your consent because they may impact your score, but they will disappear from your credit profile after 2 years.

- A soft inquiry appears on a credit profile, but only you can see it. Companies routinely inquire, or “pull” their clients’ credit information to ensure that credit worthiness is still the same as it was when they extended credit and that no major changes (e.g., bankruptcy) took place. These soft inquiries don’t affect your score and therefore companies don’t need to ask permission to perform them.

Second, consumers should understand how shopping around for a car loan or finding the best mortgage rates will affect their credit score. The impact is actually minimal since credit scores aren’t affected by multiple inquiries from these types of lenders within a short period of time. Instead, they're usually treated as a single inquiry, so as not to penalize consumers. (So go ahead and shop around for the best rate!)

Still, the number of hard inquiries on your account does impact your credit score, as demonstrated in the following table, which shows the relationship between the number of hard inquiries and credit score:

| Number of hard inquiries | Avg. credit score |

| 0 hard inquiries | 726 |

| 1-2 hard inquiries | 700 |

| 3-6 hard inquiries | 667 |

| 7-10 hard inquiries | 627 |

| 11+ hard inquiries | 603 |

Types of credit used

Finally, another 5-10% of your credit score is based on the types of credit used.

This includes revolving accounts (e.g., credit cards), retail accounts (e.g., store charge cards), and installment debt (e.g., auto, mortgage, and student loans). For the best credit score, have a mix of credit types that you will actually utilize.

There exists unofficial “good” and “bad” debt types (and then some in between). Credit card debt is considered “bad.” But creditors consider reasonable home mortgages a “good” debt since the appreciated value of a house will likely cover any debt default. Student loans straddle the middle ground: they are “good” debt in that job marketability and employment options will presumably increase due to education, but “bad” in that the national default rate for student loans is at an all-time high (approximately 15%) after tough economic times.

Frequently-asked questions about credit score components

How does applying for a credit card impact my credit score?

Lenders look at inquires on your credit (e.g., applying for a credit card) in two different ways; one can hurt your score, and the other does not.

- A hard inquiry occurs when a lender or credit card issuer views your credit report in order to make a lending decision. These inquires need to be authorized by you, and they usually occur when you application for a loan, mortgage, or credit card. Hard inquiries lower your score by about a few points, and remain on your credit report for two years.

- A soft inquiry occurs when an individual or company checks your credit as part of a background check, such as part of an employment application. When you check your own credit, this is also considered a soft inquiry. While they may be on your credit report, soft inquiries they do not affect your credit score.

Tip: Don't apply for several cards at once.

It’s a good idea to look around for the best card for you, but window shop, don’t buy. When creditors look at your credit rating, a breakdown of new credit makes up 10 percent of your score, and multiple credit inquiries will lower your score.

So how many applications are too many? Most lenders say that more than three applications may trigger a red flag with credit card companies.

How does paying my existing credit card balance affect my credit score?

Lenders are looking for proof that you know how to handle credit responsibly.

Remember, you do not have to keep an unpaid balance to show this responsibility. You can improve your score by paying off any existing balances in full each month.

If you are not able to pay off all your debt, then financial experts advise that you keep your credit card utilization rate below 30 percent on each credit card balance, as well as on all of your credit cards in aggregate.

Creditors are also interested in the total dollar amount of your available credit each month, so if you have a low credit limit, don't be concerned if your credit utilization rate is slightly higher.

The best way to avoid potential problems is by paying your balance each month. By doing so, you will avoid interest rates, late fees, and damage to your credit score.

Should I close my unused credit cards?

Although it may seem counterintuitive, having numerous credit cards can be beneficial for your credit score.

FICO calculates your score using a ratio of the balances you owe versus your credit limits. In other words, your score is higher the more unused available credit you have at the end of each month. Also, the length of your credit history with a card holder makes up 15 percent of your score.

If you still wish to close an account, it will take a while for your score to be negatively affected, however. Since credit bureaus frequently leave closed accounts on your file for 10 years, your score will continue to reflect those accounts.

To close an account, first pay off the balance, and then write to the issuer that you want to close the account. Request a written confirmation that the account was “closed by customer” and ask that a closing report be sent to the credit bureaus. Confirm the closing by checking your credit report at annualcreditreport.com.

Can I get a copy of my credit report for free?

Short answer: Yes.

Longer answer:

- The Fair Credit Reporting Act (FCRA) requires each of the nation’s three credit reporting companies to provide you with a free copy of your credit report, upon your request, once each year. A credit report includes details on where you live, how you pay your bills and whether you have been sued or have filed for bankruptcy. Many credit reporting companies sell this information to creditors, insurers and prospective employers that use it to evaluate your applications for credit, insurance, employment or housing.

- To order your free report: Call 1-877-322-8228 or go to annualcreditreport.com.

- Many websites that advertise a “free credit report” are simply saying that as an advertising gimmick. Some of these sites will try to make you pay for free information or try to collect other personal information to sell to other companies. Be wary of these tricks. Also, if you get an email or a phone call from someone claiming to be from annualcreditreport.com, it is probably a scam. Forward the email to the FTC at spam@uce.gov.

Based on my credit score, which credit cards will I be eligible for?

- If you have an Excellent credit score: You'll most likely (except for certain special circumstance) be approved for whatever credit card you apply for.

- If you have a Good or Very Good credit score: You might not get the very best credit card offers that are out there, but you'll probably be approved for the majority of credit cards that you'll come across.

- If you have a Fair credit score: You probably won't be approved for some of the more attractive credit card offers that you'll come across (e.g., the types of rewards cards that you'll see mentioned in credit card and travel blogs, but there are still plenty of lower-tier rewards cards (and non-rewards cards, e.g., low-APR and balance transfer cards) that you'd still probably be approved for.

- If you have a Poor or Very Poor credit score (or no score, due to no credit history): You probably won't be approved for a typical sort of credit card (e.g., rewards cards), but you can still get a secured card, which will even help you rebuild your credit over time.

How to improve your credit score

Even if you have bad credit, there are steps you can take to improve your chances of being approved.

Quick tips

Do:

- Make payments (e.g., credit card payments, loan payments) before their due dates, just to minimize your risk of somehow being late.

- Lower your amount of outstanding debt as much as you can.

- Vary the types of credit you use (credit cards, auto loans, student loans, etc.)

Don't:

- Don't cancel your oldest credit cards or loans. (Cancelling them would hurt your average age of credit.)

See below for even more tips for improving your credit score.

Understand the five key factors used to calculate credit scores

There are the five key factors that go into your credit score, each of which has its own ways of improving. Those factors, which are explained in more detail earlier in this article, are summarized below.

1. Payment history

How important is it?

Your payment history is the most significant factor in your credit score, accounting for 35% of how your credit score is calculated.

How can you improve it?

The formula here is pretty simple: Pay your bill on time every month, and your credit score will go up. Miss payments and you'll see a plummeting score.

A word of warning

Most credit card companies offer a grace period when your payment is a day or two late, but even making payments that are only late by a little bit late can, over time, undermine your credit.

2. Total debt

How important is it?

The total amount of debt you have is the second most important factor in your credit score, accounting for 30% of how your credit score is calculated.

How can you improve it?

For the best results, keep your balance at less than 30% of your credit limit. If you have a high balance on one card, focus on paying it down, and try to pay off your cards at the end of each month. If you can't pay down your cards, focus on getting the lowest APR you can, as this will prevent the amount you owe from quickly skyrocketing.

3. Length of credit history

How important is it?

This accounts for about 15% of how your credit score is calculated.

How can you improve it?

You can't do much about this right now, but you should keep your card accounts open. Closing a credit card account can ding your credit score -- particularly if you've had the account for several years. Instead, if you no longer want to use a card, simply keep it open and stop putting purchases on it. If you're worried about temptation, try cutting up the card or locking it in a safe in your home.

4. New credit applications

How important is it?

This accounts for about 10% of how your credit score is calculated on average. Note, however, that new credit applications can ding your credit score by up to five points each. If you're declined, your score could plummet even lower.

How can you improve it?

Avoid applying for multiple cards if you've already been declined for one. Instead, consider a secured card. These cards almost always come with an automatic acceptance, and can help you build your credit. Likewise, remember that pre-approved cards still require an application, and that “accepting” a pre-approved offer will mean applying for a card. If you apply for multiple offers at once, your credit can suffer.

5. Types of credit

How important is it?

This accounts for about 10% of how your credit score is calculated.

How can you improve it?

The more types of credit you have – such as loans, credit cards, or a mortgage – the better your score will be. This is why opening a credit card account can help boost your credit even if you already have a good credit history.

Review your credit card statement each month

Remember that your own decisions can affect your card agreement, such as when missing payments causes your interest rates to rise. These changes in your card agreement can, in turn, affect your credit score and debt load.

For example, if your APR increases, so too will your debt. If you carry a large balance from month to month, your debt load can quickly double, taking you over your credit limit and resulting in soaring fees. Consequently, you not only need to read the fine print on your cardholder agreement; you also need to consult your bill every month. If you see an unfamiliar charge or a rate hike you don't understand, call your credit card company right away. Even if the error is your own, some credit card companies are willing to cut you some slack to keep your business – particularly if you have good credit or have been a customer for several years.

Take steps to protect yourself from identity theft

Another way your credit can be ruined is if your card is stolen or an identity thief gains access to your information. To prevent this nightmare scenario, make sure to take the following precautions:

- Review your statements:

- As mentioned above, review your credit card statement each month (even if you know you didn't make any purchases).

- Likewise, regularly sign in to your online account to review your credit card statement.

- Lost/stolen card:

- If your credit card ever gets lost or stolen, contact your credit card company to report it lost/stolen, and freeze your credit. (Note: Failure to report it lost/stolen may cause you to lose your protection, which would mean you'd be stuck paying the bill for any unauthorized transactions.)

- Protect your personal info:

- Never give out private information via email, and never give your credit card passwords or PIN to strangers.

- Shred your credit card statements before putting them in the trash.

- Cut up your credit cards when you're no longer using them, particularly if you throw them in the trash.

For a (possible) quick boost, pay off your balances in the weeks before applying for a new card

If your score is not what you would like it to be, you can boost your score by paying off your existing balances in the weeks before you submit your card application. By lowering your credit utilization to about 5 percent, you will show lenders that you are serious about getting your finances in order.

The longer the time period goes that you are paying your bills on time, the more your score will increase.

Find and fix errors in your credit report

First, it’s time to get your finances in order. You can begin by knowing your current credit score. You can get your credit report for free by going to annualcreditreport.com or by calling 877-322-8228.

When you receive your report, check it carefully for accuracy and report any errors in your payment history to the credit bureau and/or its reporting agency.

Reduce your debt

Although it’s easier said than done, work on reducing your debt.

Using your credit report, make a list of all of your accounts and then check current statements to find out how much you owe and what interest rate is being charged on each account. Determine a plan for paying down the highest-interest cards first, while making at least minimum payments on any other accounts.

If you’ve missed any payments, do what you can to get current and stay current on your bills. It’ll take some time and discipline, but if you repair your accounts, your credit score will slowly improve.

Realize that another card won’t be a silver bullet

Many credit card companies offer incentives to newcomers with low or 0% balance transfer fees. Resist this temptation. Applying for a new credit card is not a solution to your financial problems. Opening new accounts will not help your credit rating, and, in fact, may further damage it. Here’s why:

- Having multiple cards means more work managing them. If you miss a due date or pay the wrong amount to the wrong card, you can incur costly late fees. Missed payments can lead to increased interest rates.

- It’s easier to run up more bills with multiple cards. Credit cards are tools and, as such, they can make life easier or harder. A new card can help you consolidate your debt, or it can help you get deeper in debt, depending on the way you manage it.

- Multiple credit cards mean multiple credit rating checks. There are two types of inquiries that affect your credit report:

- Hard inquiries happen when a lender checks your credit report when making a decision on your application for a loan, credit card, or mortgage. Hard inquiries, which require your permission, will lower your credit score by a few points and remain on your credit report for two years.

- Soft Inquiries happen when a company checks your report as part of a background check, such as for employment, when you are "pre-approved" for credit card offers, and even when you check your credit score yourself. Soft inquiries, which do not require your permission, may be recorded in your credit report, but they do not affect your credit score.

Explore other options

If you have bad credit or no credit, you might want to explore these two options:

- Secured credit cards. Designed for people with no credit or bad credit, secured credit cards require a cash deposit upon applying. But be on the lookout for unfavorable terms, such as a high interest rate (APR) or a high annual fee.

- Co-signer. If you have a responsible relative who is willing to take the risk, a co-signer is a good way to jump-start your credit. Be aware that what you do with your account will affect your co-signer’s credit rating, but if you are dependable, it can work out well for both of you. Once you qualify for a card on your own, you can close the joint account and open one on your own.

Use credit responsibly

The best ways to re-build your credit score are to avoid using more than 30% of your available credit, and to pay off your balances.

To help stay on top of your due dates, you can schedule payment reminders. Some credit card companies will send you an automatic email or text message reminders with your balance and due date.

Once you have caught up on your bills, it's important to pay off your entire balance each month.